Retirement is a stage many Nigerians approach with both hope and worry. The question is always the same: how will I survive financially? While some depend on pensions or children, these options often fail to provide lasting security. A strong alternative is real estate development. This strategy not only builds wealth but also guarantees long-term stability.

Real Estate Development as a Retirement Plan<

Unlike stocks or bonds, property is tangible. You can see it, touch it, and pass it down. Nigerians value assets that grow with time, and real estate development fits perfectly. By building or investing in properties, you secure income streams that can last a lifetime.

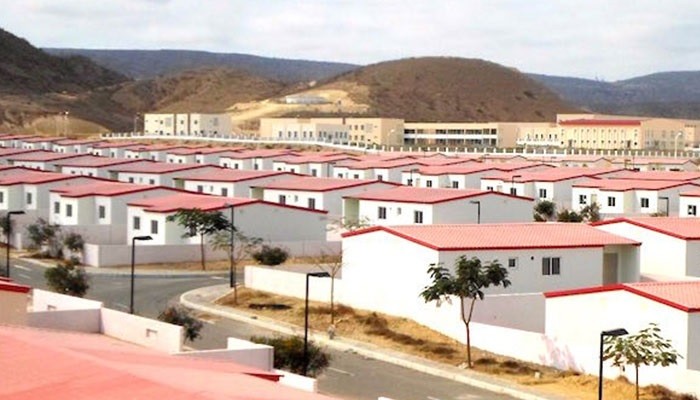

When retirement comes, many people face declining income. However, rental properties offer consistent cash flow. With real estate development, you can construct residential homes, shops, or apartments. These spaces generate steady rent that supports you through old age.

Inflation Protection

Nigeria’s economy is unpredictable, and inflation is a major challenge. Savings in banks often lose value quickly. However, property values usually rise as inflation grows. Developing real estate is like planting a tree that grows stronger with time. Your investment not only survives inflation but beats it.

Multiple Income Streams

One advantage of real estate development is the ability to diversify income. You may build apartments, office spaces, or student hostels. Each project creates a separate source of revenue. During retirement, these streams combine to provide financial freedom. Few investments offer such flexibility.

Low Risk Compared to Other Investments

Many Nigerians fear losing money in risky ventures. Stocks crash, businesses collapse, and foreign exchange is unstable. Real estate stands out because land and buildings rarely lose value. Even if the market slows, properties still hold long-term worth. With careful planning, real estate development reduces risk while providing peace of mind.

Legacy Building

Retirement is not only about comfort but also legacy. Parents dream of leaving something valuable for their children. Properties last across generations and carry family pride. Through real estate development, you create a legacy that supports children and grandchildren. This gives meaning beyond financial returns.

Accessible Financing Options

In the past, developing properties was seen as impossible for ordinary Nigerians. Today, new financing models exist. Cooperative societies, mortgage banks, and joint ventures make projects achievable. Even fractional ownership platforms allow smaller contributions. These opportunities open the door for average Nigerians to start real estate projects early.

Community Impact

When retirees invest in real estate, the benefits extend beyond personal gain. Developed properties provide housing, jobs, and business opportunities. Communities grow stronger, and the economy becomes more stable. Retirement planning, therefore, becomes a tool for national development.

Steps to Start Early

The best time to begin preparing for retirement is today. Nigerians can start by buying land in growing areas. After securing land, gradual building follows. Even small-scale projects, like single flats, grow into larger assets. Over time, these investments compound, creating a strong retirement plan.

Why Nigerians Should Choose Real Estate Development

No other investment offers the same balance of safety, growth, and legacy. Real estate grows with time, creates income, and provides protection against inflation. It also connects emotionally, offering security and a sense of ownership. For Nigerians looking at retirement, real estate development is not just an option. It is the ultimate plan.

Conclusion

Retirement should not be a time of stress. With the right strategy, it becomes a season of rest and fulfillment. By embracing real estate development, Nigerians can create a secure and lasting future. This path ensures income, legacy, and peace of mind. It truly is the ultimate retirement plan.