Real estate is one of the most rewarding investment options in Nigeria, combining stability, wealth creation, and tangible assets. With rapid urbanization, infrastructure development, and an increasing demand for housing, the Nigerian real estate sector is poised for significant growth. As we approach 2025, market conditions align perfectly to create unprecedented opportunities for investors. Whether you are a seasoned investor or a beginner, understanding why 2025 is an ideal time to invest will help you position yourself for success.

This article explores the Nigerian real estate market’s current state, the opportunities available, and actionable steps to start your investment journey in 2025.

Overview of the Nigerian Real Estate Market

The Nigerian real estate market has evolved significantly over the last decade, reflecting the country’s economic growth and population expansion. Here are some notable trends:

- Urbanization: Over 50% of Nigeria’s population now resides in urban areas, with cities like Lagos, Abuja, and Port Harcourt experiencing a surge in housing demand.

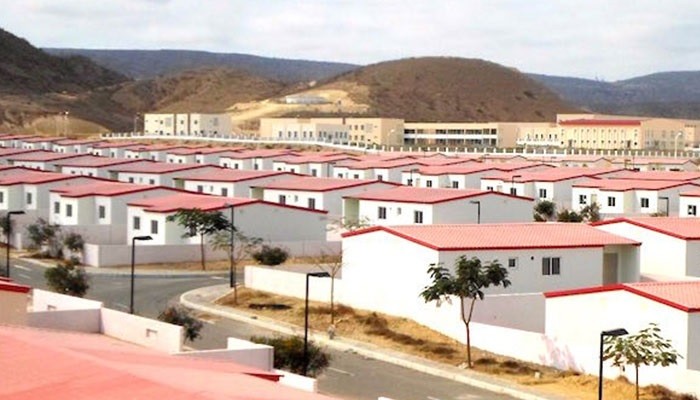

- Housing Deficit: The country’s housing deficit exceeds 20 million units, underscoring the need for affordable and accessible housing solutions.

- Rising Middle Class: As incomes grow, more Nigerians are seeking property ownership as a form of wealth accumulation.

- Economic Reforms: Recent reforms aimed at stabilizing the economy have improved investor confidence, making real estate a preferred investment choice.

With these factors in play, the real estate market is expected to thrive in 2025, presenting ample opportunities for both local and international investors.

Key Reasons Why 2025 Is Ideal for Real Estate Investment

Several unique factors make 2025 the perfect year to dive into Nigerian real estate:

- Government Policies Favoring Real Estate: The government has introduced tax incentives, affordable housing schemes, and land reforms to attract investors. Initiatives like the Family Homes Fund and National Housing Fund make property ownership more accessible.

- Economic Stability: Efforts to diversify the economy and reduce inflation are yielding positive results. GDP growth projections for 2025 indicate a stable economic environment conducive to real estate investment.

- Infrastructure Development: Massive infrastructure projects, such as railways, expressways, and smart city initiatives, are enhancing connectivity and property value. Areas like Ibeju-Lekki (home to the Dangote Refinery) and Eko Atlantic City in Lagos exemplify this trend.

- Increased Demand for Housing: With Nigeria’s population expected to exceed 220 million in 2025, the demand for housing continues to outstrip supply, ensuring a steady market for residential properties.

- Rise of PropTech Solutions: Technology is revolutionizing real estate transactions, making it easier to search, evaluate, and manage properties. This digital transformation reduces risks and streamlines processes for investors.

Emerging Investment Opportunities in Nigerian Real Estate in 2025

Investors can explore several profitable niches in Nigerian real estate:

- Residential Real Estate: High demand for affordable housing presents opportunities in cities like Lagos, Abuja, and Ogun State. Luxury apartments in highbrow areas such as Ikoyi and Victoria Island also remain lucrative.

- Commercial Real Estate: The rise of shopping malls, office buildings, and mixed-use developments caters to Nigeria’s growing retail and business sectors.

- Industrial Real Estate: Warehousing and logistics hubs are in high demand, driven by the growth of e-commerce and industrial expansion.

- Land Banking: Investing in undeveloped land in emerging areas offers substantial appreciation potential. Locations like Epe and Ibeju-Lekki are ideal for land banking.

- Short-Term Rentals: The growth of tourism and business travel makes short-term rental properties a profitable option, especially in major cities and tourist hubs.

Steps to Begin Investing in Nigerian Real Estate

Starting your real estate journey in 2025 requires careful planning and execution. Here’s a step-by-step guide:

Step 1: Assess Your Financial Readiness

Determine how much you can afford to invest. Include costs such as property acquisition, legal fees, taxes, and maintenance in your calculations.

Step 2: Set Clear Goals

Identify your objectives. Are you aiming for rental income, long-term capital appreciation, or quick resale profits?

Step 3: Conduct Market Research

Study market trends, identify high-growth areas, and understand demand-supply dynamics. For instance, Lagos offers high returns but comes with higher costs, while Ibadan and Enugu provide more affordable entry points.

Step 4: Choose the Right Property Type

Decide whether to invest in residential, commercial, or industrial properties based on your goals and budget.

Step 5: Perform Due Diligence

Verify property titles, zoning regulations, and ownership history to avoid disputes. Engage legal and survey professionals for guidance.

Step 6: Explore Financing Options

If needed, consider mortgages, partnerships, or investing through Real Estate Investment Trusts (REITs) for a lower-cost entry.

Top Locations for Real Estate Investment in Nigeria 2025

Location is a critical factor in real estate success. Here are some hotspots to consider in 2025:

Lagos:

The economic nerve center of Nigeria offers numerous opportunities, from luxury properties in Ikoyi to affordable housing in Ibeju-Lekki. The ongoing development of the Lekki Free Trade Zone further boosts the area’s appeal.

Abuja:

The capital city is ideal for high-end residential and commercial investments. Districts like Gwarinpa, Wuse, and Jabi offer a mix of luxury and mid-range options.

Ogun State:

Close proximity to Lagos and industrial zones makes Ogun an attractive destination for residential and industrial investments.

Port Harcourt:

This oil-rich city provides opportunities in residential, commercial, and industrial real estate. GRA remains a prime location for premium properties.

Emerging Cities:

Enugu, Ibadan, and Uyo are gaining traction due to affordability and improving infrastructure. These cities are perfect for land investments and affordable housing projects.

Potential Challenges and How to Overcome Them

Investing in Nigerian real estate comes with its share of challenges. Here’s how to tackle them:

- Fraud and Scams: Avoid fake agents and disputed properties by verifying documents and working with reputable professionals.

- Bureaucratic Processes: Engage experienced lawyers to navigate property registration and approvals efficiently.

- High Capital Requirements: Start small or explore partnerships and REITs to ease financial burdens.

- Economic Uncertainty: Diversify your portfolio to mitigate risks from inflation or currency fluctuations.

- Infrastructure Deficits: Focus on areas with ongoing or planned infrastructure projects to ensure value appreciation.

Tips for Maximizing Returns in 2025

Here are actionable tips to succeed in Nigerian real estate:

- Invest Early: Enter the market in emerging areas before prices surge.

- Leverage Technology: Use PropTech tools for property searches, market analysis, and investment management.

- Diversify Your Portfolio: Spread your investments across different property types and locations to minimize risks.

- Work with Professionals: Engage reliable agents, lawyers, and surveyors to avoid costly mistakes.

- Stay Informed: Monitor market trends, government policies, and infrastructure developments to make informed decisions.

Conclusion

As 2025 approaches, the Nigerian real estate market offers unmatched opportunities for wealth creation. Government policies, infrastructure development, and a growing population set the stage for a thriving sector. By understanding the market, identifying the right opportunities, and taking calculated steps, you can secure your share of this promising industry.

Don’t wait for the perfect moment; the time to act is now. Start your journey today and unlock the vast potential of Nigerian real estate in 2025.