Buying real estate in Nigeria is one of the smartest financial decisions you can make. Land and property ownership not only provide long-term security but also offer great investment returns. However, many Nigerians and diaspora investors fall into costly traps when trying to acquire property. To succeed in the real estate market, it’s important to know the common mistakes and how to avoid them.

1. Skipping Proper Land Verification

One of the biggest mistakes is buying land without verifying the documents. Fraudsters often sell land that is under government acquisition, disputed, or already sold to multiple buyers. Always confirm the title documents with the Land Registry. If possible, hire a property lawyer to conduct due diligence before making payments.

2. Ignoring Location Research

Many buyers rush into purchasing land simply because the price is cheap. While affordability is important, location determines the long-term value of your investment. Is the property close to major roads, schools, or business centers? Does the area have a history of flooding or disputes? Always prioritize location over price.

3. Not Working With Professionals

Some buyers try to save costs by avoiding agents, surveyors, or lawyers. This often leads to bigger losses. Professionals ensure the land is genuine, boundaries are clear, and documents are valid. It’s better to pay for professional help upfront than to lose millions later.

4. Falling for Sweet Promises From Developers

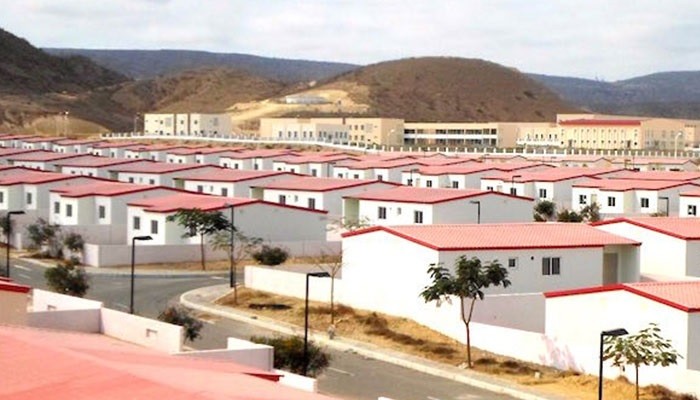

Real estate in Nigeria has seen a rise in estate developers who sell plots with promises of rapid development. While many are genuine, some overpromise and underdeliver. Before buying, visit the site yourself, check the company’s track record, and speak with other investors. Don’t rely only on glossy adverts.

5. Overstretching Your Finances

Buying property should not leave you financially stranded. Some buyers borrow heavily or invest their entire savings, leaving nothing for emergencies. Instead, create a budget and stick to it. If the property is beyond your reach now, consider installment plans or smaller plots. Real estate in Nigeria appreciates quickly, so you can always scale up later.

6. Neglecting Future Plans for the Area

A property that looks unattractive today might become prime land tomorrow. Similarly, a flashy area might lose value if infrastructure fails. Always check the government’s master plan for roads, industries, or future developments. This research ensures your property aligns with future growth.

7. Forgetting to Register the Property

Many Nigerians buy land, collect documents, and stop there. If the property is not registered with the relevant authorities, disputes can arise in the future. Always process your Certificate of Occupancy (C of O) or Governor’s Consent. Proper registration makes you the legal owner.

8. Emotional Buying

Some buyers get carried away by excitement or pressure from agents. Real estate should never be bought on impulse. Take your time, research the property, and ask questions. An emotional decision today could lead to regret tomorrow.

9. Ignoring Hidden Costs

The purchase price is not the only expense in real estate transactions. There are survey fees, agency commissions, legal charges, and government taxes. Failing to budget for these can delay your project. Always ask for the total cost before making commitments.

Conclusion

Buying real estate in Nigeria can be rewarding, but only if you avoid common mistakes. Verify documents, work with professionals, and research the location before paying a dime. Don’t allow excitement or pressure to cloud your judgment. With the right steps, your real estate investment will bring lasting wealth, security, and peace of mind.