Nigerian Real Estate Market: A Week-in-Review

The Nigerian real estate market continues to exhibit a dynamic interplay of factors, with a blend of opportunities and challenges shaping its trajectory. This week’s review delves into the key developments that have influenced the market, providing insights into price movements, policy shifts, and emerging trends.

Market Trends In The Nigerian Real Estate Market

Price Movements

Residential property prices in Lagos, Nigeria’s economic hub, have shown a marginal increase of 2% this week. This upward trend is primarily driven by sustained demand for housing units in prime locations such as Ikoyi and Lekki. However, the mid-income segment remains relatively stable, reflecting a cautious approach by buyers due to economic uncertainties.

Abuja, the nation’s capital, witnessed a steady property market with minimal price fluctuations. The commercial property sector, particularly office spaces, continues to face challenges due to the ongoing remote work culture adopted by many organizations.

Supply and Demand

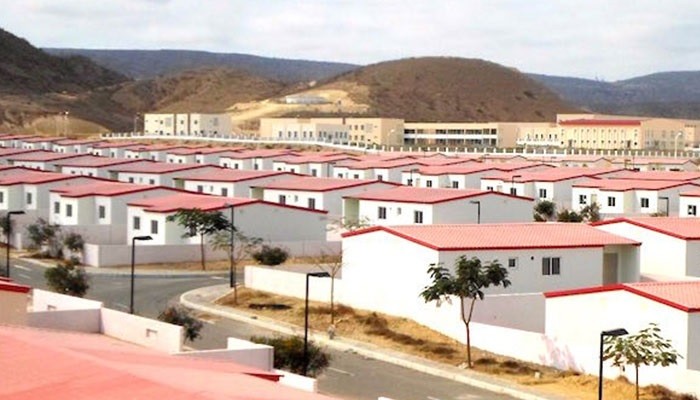

The demand for residential properties in major cities remains robust, with a particular focus on affordable housing units. Developers are responding to this trend by launching new projects targeting the mid-income segment. Nevertheless, the supply of luxury apartments and high-end houses still outpaces demand, leading to potential price adjustments in these categories.

Investment Trends

Private equity firms and institutional investors are showing increased interest in the Nigerian real estate market. Notable investments this week include a $50 million fund allocated to developing affordable housing projects in Ibadan and a partnership between a local developer and a foreign investor to construct a mixed-use complex in Abuja.

Policy and Regulatory Updates to Watch out For

Government Policies

The government has announced plans to introduce tax incentives for real estate developers undertaking affordable housing projects. This initiative aims to stimulate investment in the low-income housing segment and address the country’s housing deficit. Additionally, discussions are ongoing regarding potential reforms to land administration processes to enhance transparency and reduce bureaucratic bottlenecks.

Regulatory Changes

The regulatory landscape remains relatively stable, with no significant changes reported this week. However, industry stakeholders are closely monitoring developments related to foreign exchange policies, as these can impact property valuations and investment decisions.

Economic Indicators

Exchange Rate Fluctuations

The Naira’s exchange rate against major currencies has experienced moderate volatility this week. While the Central Bank of Nigeria has intervened to stabilize the market, currency fluctuations continue to pose challenges for property developers and investors reliant on foreign exchange.

Inflation Rates

Inflationary pressures have eased slightly compared to the previous week, providing some relief to the construction industry. However, the overall economic environment remains inflationary, impacting building material costs and potentially affecting property prices in the long run.

Interest Rates

The Central Bank of Nigeria maintained its monetary policy stance, leaving interest rates unchanged. This decision is aimed at balancing economic growth and inflation control. While stable interest rates support mortgage lending and property investment, the overall cost of borrowing remains relatively high.

Market Analysis

Hotspots

The Lekki-Epe corridor in Lagos continues to be a real estate hotspot, driven by infrastructure development and the growing population. Other emerging hotspots include the Nasarawa-Abuja axis and certain areas of Port Harcourt, where industrialization and urbanization are driving property demand.

Challenges

Land disputes, inadequate infrastructure, and the high cost of construction remain significant challenges for the Nigerian real estate market. Additionally, the slow pace of judicial processes in resolving property-related disputes creates uncertainties for investors.

Opportunities

The growing middle class, urbanization, and government support for affordable housing present substantial opportunities for real estate developers and investors. Niche segments, such as student accommodation and healthcare facilities, also offer promising prospects.

Conclusion

The Nigerian real estate market demonstrated mixed signals this week, with price trends varying across different property segments. While challenges persist, the underlying fundamentals of the market remain positive, driven by population growth, urbanization, and increasing investor interest. As the real estate sector continues to evolve, staying informed about market trends and policy developments is crucial for making informed investment decisions.