The Nigerian real estate market continues to expand, offering numerous opportunities for individuals looking to build wealth. However, for those with limited capital, entering the market may seem daunting. With the right strategies and a solid understanding of the market landscape, Real Estate Investing in Nigeria is achievable even on a modest budget. This guide explores practical methods to start your journey into Nigerian real estate investing in 2025.

Understanding the Nigerian Real Estate Market

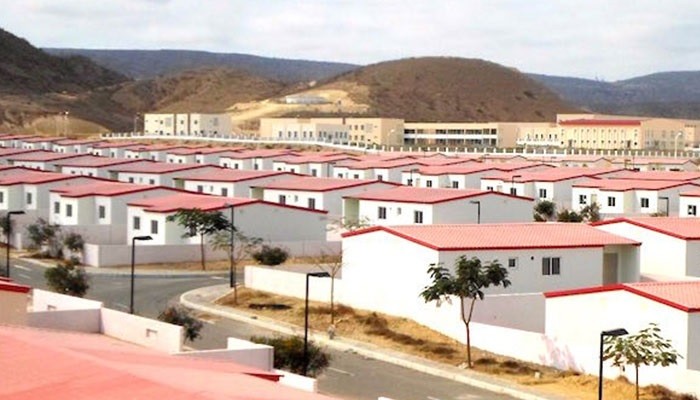

Nigeria’s real estate market remains a promising sector due to its rapidly growing population and increasing urbanization. As of 2025, the country faces a significant housing deficit, particularly in major cities like Lagos, Abuja, and Port Harcourt. This gap presents a lucrative opportunity for Real Estate Investing in Nigeria, allowing investors who can tap into the demand for residential, commercial, and mixed-use properties.

Key trends shaping the market in 2025 include:

- Urbanization: The migration of people from rural areas to urban centers continues to drive housing demand.

- Technological Advancements: PropTech (Property Technology) solutions are streamlining property transactions, making investing more accessible.

- Government Policies: Initiatives like the National Housing Fund and tax incentives for property developers aim to boost investment in the sector.

Understanding these dynamics can help small-scale investors identify opportunities that align with their budget and long-term goals.

Benefits of Starting Small in Real Estate Investing

Starting with limited capital has its advantages. Here are some key benefits:

- Lower Financial Risk: Investing small amounts reduces exposure to significant losses, providing a safer entry point for beginners.

- Learning Opportunity: Starting small allows you to gain practical experience and understand market dynamics before scaling up.

- Flexibility: Small-scale investments offer the freedom to diversify across different types of real estate ventures, such as land banking, REITs, or short-term rentals.

These benefits make it possible to build a sustainable portfolio gradually while minimizing financial pressure.

Strategies for Real Estate Investing with Limited Capital

Here are practical strategies tailored for Nigerian investors with limited capital:

1. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) provide an accessible way to invest in real estate without owning physical property. REITs pool funds from multiple investors to purchase, manage, or finance income-generating properties. As an investor, you earn dividends from the rental income or capital appreciation of the properties.

- Advantages: High liquidity, low entry cost, and professional management.

- How to Get Started: Research Nigerian REITs listed on the stock exchange or consult financial advisors to identify reputable options.

REITs are an excellent choice for individuals looking to start small while gaining exposure to the real estate market.

2. Land Banking

Land banking involves purchasing undeveloped land in areas with high growth potential and holding it until its value appreciates. This strategy is particularly effective in Nigeria, where urban expansion is creating demand for land in the outskirts of major cities.

- Steps to Begin:

- Research areas with affordable land prices and significant growth potential (e.g., satellite towns around Lagos or Abuja).

- Verify land ownership and legal documentation to avoid disputes.

- Work with trusted real estate agents or firms.

- Benefits: Low initial cost and potential for high returns over time. Land banking is a long-term investment strategy ideal for those with patience and foresight.

3. Partnerships and Co-Investment

Pooling resources with other investors is an effective way to overcome capital constraints. Co-investment allows individuals to share the cost of acquiring properties while benefiting from shared expertise and reduced financial burden.

- How to Form Partnerships:

- Identify like-minded individuals or groups with shared investment goals.

- Draft a clear agreement outlining responsibilities, profit-sharing, and exit strategies.

- Use legal professionals to formalize the partnership.

Collaborating with others not only makes real estate investing more accessible but also helps mitigate risks.

4. Short-Term Rentals and Subleasing

The short-term rental market in Nigeria, driven by platforms like Airbnb, offers another avenue for small-scale investors. Subleasing, in particular, allows you to generate income without owning property.

- Steps to Start:

- Lease a property with the owner’s consent for short-term rental purposes.

- Furnish and market the property to attract guests.

- Ensure compliance with local laws and regulations.

This strategy requires minimal capital and provides a steady income stream, especially in tourist hubs or major cities.

5. Crowdfunding Platforms

Real estate crowdfunding is a relatively new but growing trend in Nigeria. It involves pooling funds from multiple investors to finance property developments or acquisitions. These platforms allow individuals to invest small amounts and earn returns proportional to their contributions.

- How to Participate:

- Research reputable real estate crowdfunding platforms operating in Nigeria.

- Review the terms, expected returns, and associated risks.

- Start with a small investment to test the waters.

Crowdfunding democratizes real estate investing, making it accessible to individuals who might otherwise be excluded due to high entry costs.

Tips for Successful Real Estate Investing with Limited Capital

To maximize your success as a small-scale real estate investor, consider the following tips:

- Conduct Thorough Research: Understand market trends, property values, and potential risks before making any investment.

- Build a Network: Connect with real estate professionals, agents, and fellow investors to gain insights and discover opportunities.

- Start Small and Scale Gradually: Focus on low-cost opportunities initially and reinvest profits to grow your portfolio.

- Leverage Technology: Use PropTech tools for property search, market analysis, and transaction management.

- Seek Professional Advice: Work with legal and financial advisors to navigate complex regulations and ensure compliance.

Conclusion

Real estate investing in Nigeria is a viable path to wealth creation, even for those with limited capital. By leveraging strategies like REITs, land banking, partnerships, short-term rentals, and crowdfunding, you can build a diversified and sustainable investment portfolio.

Success in real estate requires patience, research, and a willingness to learn. Start small, stay informed about market trends, and continuously refine your approach. With determination and the right strategies, you can achieve your real estate investment goals in 2025 and beyond.