Hottest Real Estate Investment Zones in Nigeria Right Now

Nigeria, Africa’s most populous nation, is experiencing rapid urbanization and economic growth, making it a lucrative market for real estate investors. Identifying the hottest real estate investment zones is crucial for maximizing returns and mitigating risks. This article explores the key factors influencing these zones and highlights the most promising locations for investment in Nigeria.

Factors Determining Hot Real Estate Investment Zones

Several factors contribute to the designation of a real estate investment hotspot. Economic growth, infrastructure development, demographic shifts, government policies, and security are key determinants.

- Economic growth and development: Regions with thriving economies, job creation, and increasing disposable incomes typically experience robust real estate growth.

- Infrastructure development: Adequate transportation, power supply, and telecommunications are essential for property value appreciation and attracting investors.

- Demographic trends: Population growth and urbanization drive demand for housing, commercial spaces, and infrastructure.

- Government policies and incentives: Supportive government policies, such as tax breaks and zoning regulations, can stimulate real estate investment.

- Security and stability: A secure environment is crucial for attracting investors and ensuring property value appreciation.

Hottest Real Estate Investment Zones in Nigeria

Nigeria boasts several regions with immense potential for real estate investment. Let’s delve into some of the hottest zones:

Lagos: The Economic Hub

Lagos, Nigeria’s commercial capital, remains the top choice for real estate investors. Its dynamic economy, burgeoning population, and vibrant lifestyle make it a magnet for both local and foreign investors.

- Ikoyi and Victoria Island: Known for their upscale lifestyle, these districts offer high-end residential, commercial, and hospitality properties.

- Lekki and Ajah: Rapid development and infrastructure improvements have transformed this area into a sought-after residential and commercial hub.

- Mainland Lagos: Affordable housing options and emerging commercial districts make Mainland Lagos an attractive investment prospect for mid-income earners.

Abuja: The Federal Capital Territory

As Nigeria’s political and administrative center, Abuja offers a stable and growing real estate market.

- Maitama and Asokoro: These high-end districts house government officials, diplomats, and affluent residents, driving demand for luxury properties.

- Gwarimpa and Katampe: These residential areas offer a mix of affordable and mid-range housing options, catering to a broader market.

- Abuja Airport Road: This corridor is experiencing rapid commercial development, with opportunities for office spaces, retail outlets, and hospitality establishments.

Other Emerging Zones

Beyond Lagos and Abuja, several other cities are emerging as real estate investment hotspots.

- Port Harcourt: Nigeria’s oil and gas capital offers opportunities in both residential and commercial real estate, driven by the growing middle class.

- Kano: As the commercial hub of northern Nigeria, Kano presents potential for investment in residential, commercial, and industrial properties.

- Ibadan: With a large population and a growing economy, Ibadan is becoming an attractive destination for affordable housing and commercial developments.

- Enugu: The capital of Enugu State is experiencing urban renewal and infrastructure improvements, making it a potential investment hub.

- Calabar: Known for its tourism potential, Calabar offers opportunities in hospitality, residential, and commercial real estate.

Investment Opportunities in These Zones

The demand for various property types is driving investment opportunities in these hot zones.

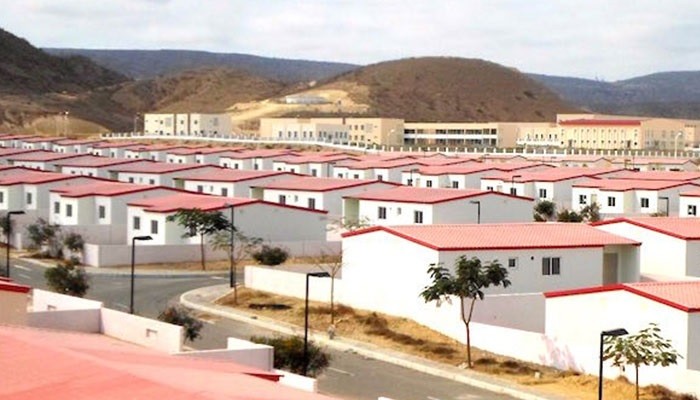

- Residential properties: Housing shortages and urbanization create demand for both affordable and luxury housing.

- Commercial properties: Growing businesses and expanding retail sectors necessitate office spaces, shopping malls, and commercial complexes.

- Industrial and logistics real estate: Nigeria’s industrialization drive presents opportunities for warehouses, factories, and distribution centers.

- Land acquisition: Strategic land purchases can yield significant returns as development progresses.

Risks and Challenges

While these zones offer promising investment prospects, investors must be aware of potential risks and challenges.

- Economic volatility: Nigeria’s economy can be susceptible to fluctuations, impacting property values and rental yields.

- Political instability: Political uncertainties can create market instability and affect investment decisions.

- Land disputes: Complex land ownership issues can delay projects and increase legal risks.

- Infrastructure gaps: Inadequate infrastructure can hinder property development and value appreciation.

Tips for Investing in Hot Zones

To maximize returns and mitigate risks, consider the following tips:

- Conduct thorough market research: Analyze market trends, property values, and rental yields before investing.

- Partner with local experts: Collaborate with experienced real estate professionals to navigate the local market.

- Diversify your investment portfolio: Spread your investments across different property types and locations to reduce risk.

- Consider long-term investment horizons: Real estate investments typically yield higher returns over the long term.

Conclusion

Nigeria’s real estate market is dynamic and offers substantial opportunities for investors. By carefully analyzing the hottest investment zones and understanding the associated risks, investors can position themselves for success. Continuous monitoring of market trends and government policies is essential for making informed investment decisions.