Nigeria is one of Africa’s largest and fastest-growing economies, making it an attractive destination for property investment. With a population of over 200 million people and rapid urbanization, the demand for housing, commercial spaces, and luxury properties is constantly rising. For foreign investors, the opportunities in real estate in Nigeria are enormous—but knowing where to start is essential.

Why Invest in Real Estate in Nigeria?

Strong Demand – Nigeria’s urban population is expanding quickly. Cities like Lagos, Abuja, and Port Harcourt face constant housing shortages, creating opportunities for developers and landlords.

High Returns – Property values and rental yields in prime locations are among the best in Africa. Investors who understand the market can enjoy long-term growth.

Diverse Options – From luxury apartments in Lagos to affordable housing projects in Ibadan, the market caters to different budgets and goals.

Diaspora Demand – Many Nigerians abroad are investing heavily in real estate back home, further driving growth.

Legal Framework for Foreign Investors<

Foreigners are allowed to own property in Nigeria, but it must be through a leasehold system. Land is owned by the government, and buyers acquire usage rights for up to 99 years. To avoid disputes, investors must:

Work with a trusted property lawyer.

Verify documents like the Certificate of Occupancy (C of O) or Governor’s Consent.

Ensure the land is not under government acquisition.

Legal clarity is critical for success in real estate in Nigeria.

Best Locations for Foreign Investors

Lagos – The commercial capital of Nigeria. Areas like Lekki, Victoria Island, and Ibeju-Lekki attract both luxury buyers and middle-class tenants. Lagos remains the top destination for foreign investors entering the real estate market.

Abuja – The Federal Capital Territory offers political stability and modern infrastructure. Districts like Maitama, Jabi, and Gwarinpa provide excellent rental income and long-term growth.

Port Harcourt – Known as the oil and gas hub, Port Harcourt has strong demand for residential and commercial properties, especially in GRA and new estates.

Ibadan and Ogun State – These areas are emerging as affordable alternatives to Lagos, with land prices that are still within reach.

Key Investment Opportunities

Residential Developments – Apartments, duplexes, and estates targeting middle-class families.

Short-Let Apartments – A booming sector fueled by tourism and business travelers.

Commercial Real Estate – Office buildings, retail outlets, and warehouses are in high demand.

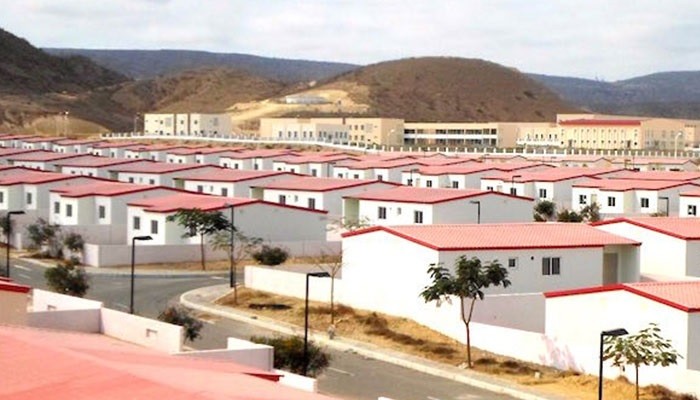

Affordable Housing Projects – Government-backed schemes encourage private developers to meet housing deficits.

By exploring these opportunities, foreign investors can tap into the growing demand for real estate in Nigeria.

Challenges to Be Aware Of

While the market is promising, there are challenges:

Title Fraud: Fake or double land sales remain a risk. Always verify ownership.

Infrastructure Gaps: Some areas lack proper roads, power, or drainage. Location research is vital.

Regulatory Delays: Getting approvals and documentation can take time.

Currency Fluctuations: Exchange rate changes may affect returns for foreign investors.

Understanding these issues helps investors plan better and reduce risks.

Tips for Getting Started

Start small and scale gradually.

Work with reputable developers, agents, and lawyers.

Focus on cities with proven growth.

Diversify into both residential and commercial properties.

Stay updated on government policies affecting the real estate sector.

Conclusion

The opportunities in real estate in Nigeria are vast, but success requires careful planning and due diligence. From Lagos’ bustling property scene to Abuja’s high-end districts, foreign investors can achieve impressive returns if they start right. With the right team, verified documents, and a clear strategy, Nigeria’s real estate market can be both profitable and rewarding.