The global diaspora community has always played a vital role in fueling economic growth back home, and one sector that continues to attract their attention is real estate. From residential properties to commercial developments, diaspora investments are becoming increasingly significant in shaping urban and rural landscapes. However, one of the most innovative trends that is making property ownership more accessible and attractive to the diaspora is fractional ownership.

Diaspora investments refer to the financial contributions made by people living outside their home countries toward businesses, infrastructure, or asset acquisitions back home. For many in the diaspora, investing in their country of origin is not only a way of staying connected but also a chance to secure financial returns while supporting local development.

Among the most preferred investment options, real estate consistently ranks at the top. It provides both tangible value and long-term wealth creation. For the diaspora, buying property also has emotional value—it represents roots, security, and a future point of return. But traditional property investment often comes with challenges such as high capital requirements, management issues, and trust concerns with developers or agents. This is where fractional ownership comes in.

Fractional ownership is a modern investment model that allows multiple investors to collectively own shares of a property. Instead of one person shouldering the entire cost of a house, office block, or resort apartment, several investors can buy fractions of it. Each investor owns a legal share of the property, enjoys proportional benefits, and shares in the profits if the property is rented or sold.

This concept is especially appealing to the diaspora community because it reduces the financial burden of buying full properties while offering access to high-value real estate projects. It allows them to diversify their portfolios and participate in lucrative markets that would otherwise be out of reach.

Affordability and Accessibility – Many diaspora members may want to invest in real estate back home but cannot afford the full cost of premium properties. Fractional ownership allows them to start small, investing amounts that align with their financial capacity.

Shared Risk – Since multiple people co-invest in the property, the risks associated with market fluctuations, vacancies, or maintenance are shared. This provides greater security for diaspora investors who may be far away and unable to monitor their properties regularly.

Passive Income – Properties purchased under fractional ownership can be rented out, generating rental income that is distributed among the investors. For diaspora investors, this provides a steady stream of income in addition to long-term property appreciation.

Diversification – Instead of putting all funds into a single property, diaspora investors can spread their investments across different locations and property types. This reduces dependency on one market and maximizes opportunities for returns.

Professional Management – Most fractional ownership models come with property management services. This is a major relief for diaspora investors who often face challenges in managing properties remotely.

Technology has made it easier than ever for diaspora investors to participate in real estate markets back home. Online platforms now allow people to browse listings, verify property details, and invest securely through digital transactions. Blockchain and smart contracts are also being integrated into fractional ownership models, providing transparency and ensuring that each investor’s rights are protected.

Future Outlook

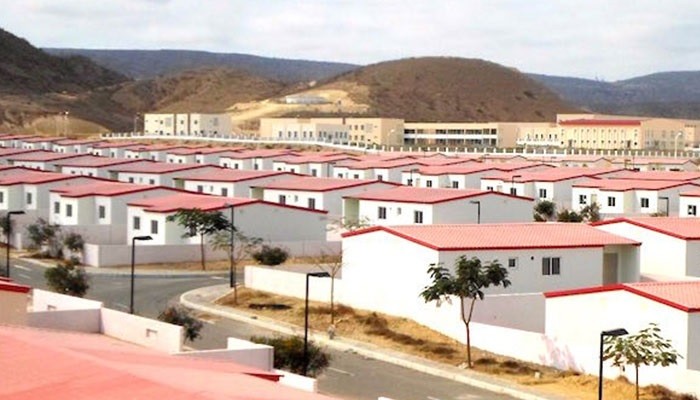

The combination of diaspora investments and fractional ownership is reshaping how people perceive property ownership. It democratizes access to high-value real estate, builds trust through transparency, and encourages collaboration among investors. As more people embrace this model, countries stand to benefit from increased inflows of diaspora capital, job creation, and sustainable urban development.

For diaspora communities eager to invest back home, fractional ownership offers a practical and innovative way to enter the real estate market. It breaks down financial barriers, reduces risks, and provides a pathway to both emotional and financial rewards. With the right legal frameworks, technology platforms, and trustworthy developers, this model could revolutionize how diaspora capital fuels the growth of the property sector worldwide.