Introduction

Real Estate Investment Trusts (REITs) have become a popular choice for investors seeking exposure to real estate without the burden of direct property ownership. By pooling funds, REITs allow investors to earn dividends from real estate investments while diversifying their portfolios. When deciding to invest in REITs, one critical consideration is choosing between commercial and residential REITs. This article explores the differences between these two categories, their advantages and disadvantages, and key factors to help investors make informed decisions.

What Are REITs?

REITs are companies that own, operate, or finance income-generating real estate. They provide an opportunity for investors to earn a share of the income produced by commercial or residential properties without having to buy, manage, or finance the properties themselves.

Broadly, REITs can be categorized into two types:

- Commercial REITs: Focus on properties like office buildings, shopping malls, hotels, and warehouses.

- Residential REITs: Invest in residential properties, including apartment complexes, single-family homes, and student housing.

Investing in REITs offers several benefits, such as steady dividend income, portfolio diversification, and liquidity compared to direct property ownership. However, understanding the nuances of commercial and residential REITs is essential for optimizing your investment strategy.

Understanding Commercial REITs

What They Are

Commercial REITs invest in properties leased to businesses. These properties include office buildings, retail spaces, industrial facilities, and hospitality venues. The income generated comes primarily from leasing these spaces to tenants for business operations.

Advantages

- Higher Rental Income Potential: Businesses often sign long-term leases, ensuring stable and predictable income streams for commercial REITs.

- Lease Agreements with Businesses: Commercial leases typically include provisions for annual rent increases, providing a hedge against inflation.

- Diversification Opportunities: Investors can diversify across various sectors such as logistics (industrial REITs) or retail (shopping malls).

Disadvantages

- Economic Sensitivity: Commercial properties are highly susceptible to economic cycles. For instance, during recessions, demand for office and retail spaces tends to decline.

- Sector-Specific Challenges: Trends like remote work and e-commerce growth have significantly impacted office and retail spaces, respectively.

- Vacancy Risks: Higher vacancy rates can occur during economic downturns, negatively affecting returns.

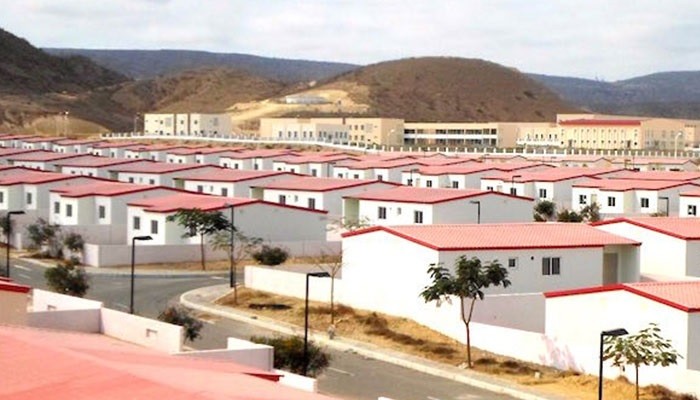

Understanding Residential REITs

What They Are

Residential REITs invest in properties rented to individuals and families. These include apartment buildings, single-family homes, senior living communities, and student housing. Income is generated from leasing these properties to tenants.

Advantages

- Stable Demand: Housing is a fundamental need, ensuring consistent demand regardless of economic conditions.

- Predictable Cash Flow: Residential properties often provide steady rental income as tenants prioritize housing payments.

- Resilience in Economic Downturns: Compared to commercial REITs, residential REITs tend to perform better during economic slowdowns.

Disadvantages

- Higher Turnover Rates: Tenants in residential properties typically sign shorter leases, leading to frequent turnover and increased operational costs.

- Regulatory Risks: Rent control policies and government regulations can cap potential income growth.

- Maintenance Costs: Managing residential properties involves regular upkeep, repairs, and tenant-related expenses.

Key Factors to Consider When Choosing

1. Market Conditions

Market dynamics play a significant role in REIT performance. Commercial REITs are heavily influenced by economic cycles and trends. For example:

- E-commerce Boom: Positively impacts industrial REITs (e.g., warehouses), while negatively affecting retail REITs.

- Remote Work: Challenges the demand for office spaces, potentially reducing the appeal of office REITs.

On the other hand, residential REITs benefit from stable housing demand, driven by population growth and urbanization. Even during recessions, people require housing, ensuring relatively steady performance.

2. Risk Tolerance

- High Risk, High Reward: Commercial REITs offer the potential for higher returns but come with increased risks, especially during economic downturns.

- Lower Risk, Steady Income: Residential REITs provide more predictable income streams, making them suitable for conservative investors.

3. Investment Goals

- Income-Focused Strategies: Investors seeking regular dividends may prefer residential REITs due to their consistent cash flow.

- Growth-Focused Strategies: Those aiming for capital appreciation may find opportunities in commercial REITs, especially in sectors like logistics or technology-driven spaces.

4. Management Quality and REIT Structure

The success of a REIT often depends on the expertise of its management team. Key considerations include:

- Track record in property acquisition and leasing.

- Quality and location of the property portfolio.

- Financial health and debt levels of the REIT.

Additionally, investors should distinguish between Equity REITs (owning and operating properties) and Mortgage REITs (financing real estate projects). Each type has unique risk and return profiles.

Pros and Cons Comparison Table

| Aspect | Commercial REITs | Residential REITs |

|---|---|---|

| Income Potential | Higher, due to business leases | Steady, but typically lower |

| Risk Level | Higher, linked to economic cycles | Lower, driven by stable housing demand |

| Lease Duration | Long-term (5-10 years) | Short-term (6-12 months) |

| Vacancy Risks | High during downturns | Moderate, but frequent tenant turnover |

| Regulatory Impact | Minimal | Significant (e.g., rent control policies) |

| Operational Costs | Lower | Higher (maintenance and tenant management) |

Final Verdict: Which One Should You Invest In?

The decision to invest in commercial or residential REITs depends on your financial goals, risk tolerance, and market outlook.

- Commercial REITs are ideal for growth-oriented investors seeking higher returns and willing to take on more risk. If you believe in the potential of specific sectors like industrial properties or are optimistic about the recovery of office spaces, commercial REITs could be a strong choice.

- Residential REITs are better suited for conservative investors who prioritize steady income and lower risk. They provide resilience in volatile markets and cater to the enduring demand for housing.

In many cases, a balanced portfolio that includes both commercial and residential REITs can offer diversification and stability. By combining the higher-income potential of commercial REITs with the steady performance of residential REITs, investors can create a well-rounded real estate investment strategy.

Conclusion

Commercial and residential REITs each have unique benefits and challenges. While commercial REITs offer higher income potential, they carry more risks due to economic sensitivity. Residential REITs, on the other hand, provide stability and steady cash flow, making them a safer option for many investors.

Before investing, it’s crucial to align your choice with your financial goals and risk appetite. Conduct thorough research or consult with financial advisors to ensure that your REIT investments complement your broader investment strategy. Share your thoughts in the comments and explore more resources to deepen your understanding of REITs.