The Nigerian real estate market in 2025 is ripe with opportunities. From urban expansion to growing infrastructure, real estate investments promise attractive returns. However, for beginners, diving into this field without adequate preparation can lead to costly mistakes. Real estate is a complex domain, and even minor errors can derail your investment journey. This article highlights the top seven mistakes Nigerian real estate beginners must avoid to succeed in 2025.

1. Lack of Proper Research

Entering the real estate market without thorough research is a recipe for failure. Beginners often underestimate the importance of understanding the market, leading to poor decisions.

Consequences of Skipping Research

- Investing in low-demand areas where property values stagnate.

- Overpaying for properties due to a lack of market knowledge.

- Falling victim to scams or purchasing problematic properties.

How to Conduct Effective Research

- Leverage Online Tools: Platforms like PropertyPro and Jiji offer insights into property prices and market trends.

- Network with Industry Experts: Real estate agents, experienced investors, and local developers can provide valuable advice.

- Visit Potential Locations: On-site visits help assess neighborhood conditions and property potential.

By investing time in research, beginners can identify profitable opportunities and avoid costly mistakes.

2. Ignoring Legal and Regulatory Requirements

Legal pitfalls are among the most common challenges for Nigerian real estate beginners. The regulatory landscape can be complex, but neglecting it can lead to severe consequences.

Common Legal Pitfalls

- Purchasing properties with unclear titles.

- Ignoring zoning laws and permit requirements.

- Falling victim to fraudulent sellers.

How to Avoid Legal Issues

- Verify Property Ownership: Always confirm ownership through government land registries.

- Work with Trusted Professionals: Hire reputable property lawyers and surveyors to conduct due diligence.

- Understand Local Regulations: Familiarize yourself with zoning laws and building codes in your target area.

Ensuring compliance with legal and regulatory requirements protects your investment and prevents future disputes.

3. Underestimating Costs

Many beginners focus solely on the purchase price, overlooking additional expenses. This oversight can strain finances and reduce profitability.

Hidden Costs in Real Estate

- Renovation Expenses: Repairs and upgrades can escalate beyond initial estimates.

- Taxes and Fees: Stamp duties, registration fees, and property taxes add to the cost.

- Maintenance Costs: Regular upkeep is essential for rental properties.

Creating a Realistic Budget

- Account for All Costs: Include purchase, renovation, taxes, and contingency funds.

- Use Budgeting Tools: Spreadsheets or financial apps can help track expenses.

- Seek Expert Advice: Consult experienced investors or financial advisors for guidance.

By accurately estimating costs, beginners can avoid financial strain and ensure profitable investments.

4. Overleveraging with Debt

Debt can be a double-edged sword in real estate. While it enables investments, overleveraging can lead to financial instability.

Risks of Excessive Debt

- High-interest payments reducing profit margins.

- Difficulty managing multiple loans simultaneously.

- Increased vulnerability during market downturns.

Strategies for Managing Debt

- Evaluate Affordability: Only borrow what you can comfortably repay.

- Opt for Favorable Terms: Seek loans with low interest rates and flexible repayment plans.

- Diversify Funding Sources: Combine personal savings with loans to reduce reliance on debt.

By balancing financing with affordability, beginners can mitigate risks and maintain financial stability.

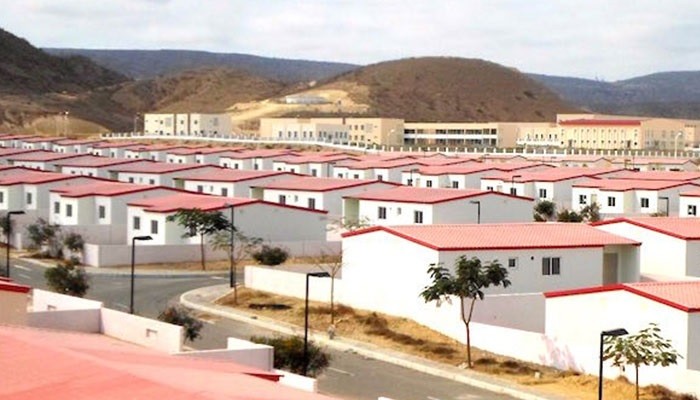

5. Choosing the Wrong Location

Location is a critical factor in real estate success. Beginners often make the mistake of investing in areas without considering demand and growth potential.

Impact of Poor Location Choices

- Properties in declining neighborhoods attract fewer buyers or tenants.

- Saturated markets limit opportunities for value appreciation.

Tips for Choosing the Right Location

- Analyze Growth Trends: Look for areas experiencing urbanization and infrastructure development.

- Consider Accessibility: Proximity to schools, markets, and transportation hubs increases property value.

- Evaluate Demand: Research rental and resale demand in your target area.

In Nigeria, emerging areas like Lekki Phase II and Epe in Lagos are gaining attention for their growth potential in 2025.

6. Neglecting Property Management

Poor property management can erode the value of your investment. Beginners often overlook the importance of maintaining properties, leading to tenant dissatisfaction and reduced returns.

Risks of Neglecting Management

- Increased repair costs due to delayed maintenance.

- Difficulty attracting or retaining quality tenants.

- Decline in property value over time.

Effective Property Management Tips

- Regular Maintenance: Address repairs promptly to prevent further damage.

- Screen Tenants: Conduct background checks to ensure reliable renters.

- Hire Professionals: Property management companies can handle tasks like rent collection and maintenance.

By prioritizing property management, beginners can preserve and enhance their investment’s value.

7. Failing to Network and Build Relationships

Real estate is a relationship-driven industry. Beginners who neglect networking miss out on valuable opportunities and insights.

Benefits of Networking

- Access to off-market properties and deals.

- Insights into market trends and investment strategies.

- Support from professionals during challenges.

Building a Reliable Network

- Attend Events: Join real estate seminars and workshops to connect with industry players.

- Leverage Social Media: Platforms like LinkedIn and Facebook groups are excellent for networking.

- Partner with Experts: Collaborate with agents, contractors, and fellow investors.

Building a strong network helps beginners navigate the complexities of real estate and achieve long-term success.

Conclusion

The Nigerian real estate market in 2025 offers immense potential for beginners. However, success requires avoiding common pitfalls that can derail your investments. By conducting proper research, ensuring legal compliance, accurately estimating costs, managing debt wisely, selecting the right locations, prioritizing property management, and building a robust network, you can set yourself up for success.

Remember, real estate is a learning journey. Mistakes are inevitable, but by staying informed and cautious, you can turn challenges into valuable lessons. With preparation and determination, the opportunities in Nigeria’s real estate market are yours to seize.