The Nigerian real estate market is brimming with opportunities for investors, thanks to its steady growth and promising projections. With an estimated valuation of $2.14 trillion by the end of 2024, real estate in Nigeria is experiencing increased demand fueled by population growth, urbanization, and government incentives. For beginners, navigating this dynamic market can seem daunting, but with the right guidance, real estate can become a lucrative and fulfilling investment. This guide will simplify the process, offering actionable insights to help you succeed in real estate investment in 2025.

Why Invest in Nigerian Real Estate?

Population Growth

Nigeria’s rapidly expanding population, estimated at over 220 million, creates a consistent demand for housing and infrastructure. This demographic growth presents significant opportunities for investors in both residential and commercial property markets.

Urbanization

Urban areas such as Lagos, Abuja, and Port Harcourt are experiencing unprecedented development. The migration to cities increases the demand for residential and commercial properties, offering attractive returns for investors.

High ROI Potential

Real estate has consistently proven to be a reliable wealth-building asset in Nigeria. Properties in strategic locations tend to appreciate in value, making real estate a viable option for those looking to grow their investments.

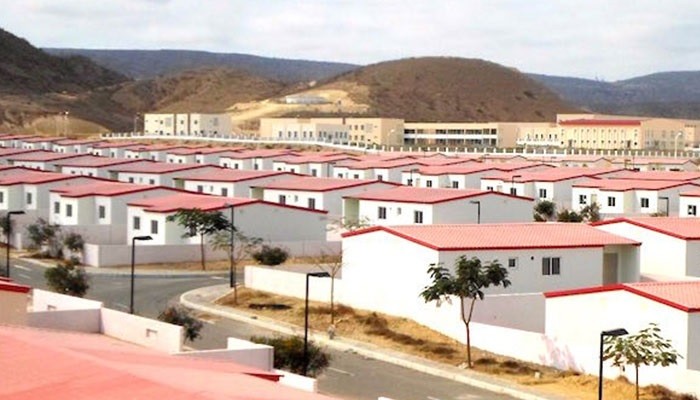

Government Policies and Incentives

The Nigerian government has introduced initiatives to encourage real estate development, particularly affordable housing projects. Incentives such as reduced taxes and favorable mortgage schemes make it easier for investors to enter the market.

Diversification Opportunity

Real estate provides a hedge against inflation and offers portfolio diversification. Investing in property can stabilize your financial portfolio, especially during economic volatility.

Understanding the Real Estate Market in Nigeria

Market Segments

- Residential Properties: This segment includes affordable housing, luxury apartments, and gated communities. The demand for residential properties is driven by urbanization and the growing middle class.

- Commercial Properties: Office spaces, shopping malls, and mixed-use developments are becoming increasingly popular in urban centers. These properties offer stable rental income and long-term value.

- Industrial Properties: Warehouses and logistics hubs are gaining traction, particularly with the growth of e-commerce and manufacturing.

- Land Investments: Buying undeveloped land in strategic locations can yield significant returns as the area develops.

Trends in 2024

- PropTech Integration: Technology is revolutionizing the real estate sector through virtual tours, online property listings, and smart home features.

- Sustainable Development: Eco-friendly building practices and renewable energy integration are becoming essential.

- Mixed-Use Developments: These projects, combining residential, retail, and office spaces, are reshaping urban living.

Top Cities to Invest In

- Lagos: Nigeria’s commercial hub offers high demand for residential and commercial properties.

- Abuja: As the political capital, Abuja provides opportunities in luxury and mid-range property markets.

- Port Harcourt: Known for its oil industry, this city has potential in both residential and industrial segments.

- Ibadan and Kaduna: Emerging cities with affordable investment opportunities and growing infrastructure.

Steps to Begin Real Estate Investment in Nigeria

1. Define Your Investment Goals

Identify whether you aim for short-term gains, such as house flipping, or long-term benefits like rental income. Your goals will guide your investment decisions.

2. Conduct Market Research

Analyze local demand, property values, and emerging trends. Understanding the market dynamics in your chosen location is crucial for making informed decisions.

3. Budgeting and Financing

Determine your financial capacity and explore financing options. Banks, mortgage institutions, and cooperative societies can provide the capital needed for property acquisition.

4. Choose the Right Investment Type

- Buy-to-Let Properties: Generate consistent rental income by leasing properties.

- House Flipping: Purchase undervalued properties, renovate them, and sell for a profit.

- Land Investments: Acquire land in developing areas for long-term appreciation.

5. Engage Professionals

Work with experienced real estate agents, lawyers, and surveyors to ensure you make sound investments. Their expertise can help you navigate legal requirements and avoid pitfalls.

6. Conduct Due Diligence

Verify property ownership, check for legal encumbrances, and inspect the property’s condition. Proper due diligence protects you from fraud and unforeseen issues.

7. Close the Deal

Negotiate favorable terms and complete all necessary documentation, such as the Deed of Assignment and Certificate of Occupancy. Ensure all paperwork is properly filed with relevant authorities.

Challenges in Real Estate Investment and How to Overcome Them

Land Disputes

Disputes over property ownership are common in Nigeria. Engage reputable lawyers and surveyors to verify land titles and boundaries before purchase.

High Initial Capital Requirement

Real estate investments often require significant upfront capital. Consider starting small or partnering with others through joint ventures or cooperative societies.

Fraudulent Practices

Scammers pose a significant risk in the property market. Conduct thorough due diligence and work with trusted professionals to minimize exposure to fraud.

Economic Instability

Nigeria’s economy can be volatile, affecting property values and demand. Focus on properties in consistently high-demand areas and diversify your investments to mitigate risks.

Government Bureaucracy

Navigating the regulatory landscape can be time-consuming. Patience and collaboration with professionals familiar with local processes can help you overcome bureaucratic hurdles.

Tips for Success in Real Estate Investment in 2024

Stay Informed About Market Trends

Keep abreast of changes in demand, pricing, and government policies. Knowledge of market dynamics is essential for making strategic decisions.

Leverage Technology

Use PropTech platforms and apps for property research, management, and transactions. Tools like virtual tours and online listings streamline the investment process.

Network with Industry Professionals

Build relationships with real estate agents, developers, and other investors. Networking provides valuable insights and potential partnership opportunities.

Consider Location First

Invest in properties located in high-demand areas with growth potential. Prime locations often offer the best returns.

Focus on Sustainability

Properties with eco-friendly features and energy-efficient designs are increasingly attractive to buyers and tenants.

Think Long-Term

Real estate is a long-term investment. Be patient and focus on gradual growth rather than quick profits.

Diversify Your Portfolio

Avoid putting all your resources into one property type or location. Diversification reduces risk and increases overall returns.

Conclusion

Real estate remains one of the most lucrative investment options in Nigeria. With the right approach, even beginners can capitalize on the opportunities presented by the market in 2024. Start by defining your goals, conducting thorough research, and working with trusted professionals. Remember, success in real estate is a journey—focus on long-term growth, stay informed, and remain consistent. The opportunities are vast, and with diligence, you can turn your real estate dreams into reality.