Real estate has long been a proven path to wealth, but owning property directly can be expensive and complex. Enter Real Estate Investment Trusts (REITs), a simpler and more accessible way for Nigerians to invest in real estate. Whether you’re an investment novice or a seasoned player, understanding REITs is essential to take advantage of this growing sector.

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. Instead of directly buying properties, investors pool their money to purchase shares in a REIT. This structure allows everyday individuals to earn returns from real estate without the hassle of managing properties.

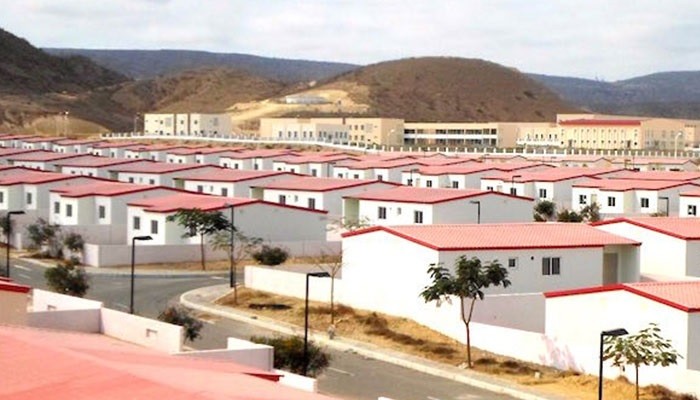

In Nigeria, REITs play a vital role in the real estate market, enabling investors to tap into lucrative opportunities in sectors such as residential, commercial, industrial, and even agricultural properties. For example, the UPDC REIT and SFS REIT are prominent options for Nigerian investors looking to diversify their portfolios with real estate exposure.

What are the Types of REITs?

To better understand REITs, let’s examine their three main types:

- Equity REITs:

These REITs own and manage income-generating properties, such as malls, office buildings, and apartments. They generate revenue primarily through rent. In Nigeria, equity REITs are popular due to the growing demand for urban housing and commercial spaces. - Mortgage REITs (mREITs):

Mortgage REITs focus on lending money for real estate projects or purchasing existing mortgages. They make money from the interest on these loans. While less common in Nigeria, mortgage REITs offer potential for higher yields. - Hybrid REITs:

Hybrid REITs combine the features of equity and mortgage REITs, offering a mix of property management and mortgage lending. This diversification helps balance risk and return, making them an appealing choice for cautious investors.

Additionally, REITs can be categorized as publicly traded (listed on stock exchanges like the Nigerian Exchange Group) or private (available to a limited group of investors). Public REITs are more accessible and provide greater liquidity, making them a preferred option for many Nigerian investors.

How Do REITs Generate Income?

REITs are designed to produce steady income for their shareholders. Here’s how they achieve that:

- Rental Income:

For equity REITs, the primary revenue source is the rent collected from tenants occupying their properties. For example, a Nigerian REIT owning commercial spaces in Lagos or Abuja earns revenue from businesses renting these spaces. - Mortgage Interest Income:

Mortgage REITs earn by financing real estate projects or buying mortgage-backed securities, collecting interest payments over time. - Dividend Distribution:

One of the standout features of REITs is their obligation to distribute at least 90% of taxable income to shareholders as dividends. This structure ensures that investors regularly receive income, making REITs attractive for income-focused strategies.

What are the Benefits of Investing in REITs?

Investing in REITs offers several advantages for Nigerians:

- Passive Income:

With REITs, investors earn regular dividends without the challenges of direct property management, such as dealing with tenants or maintenance issues. - Portfolio Diversification:

REITs allow investors to diversify their portfolios by adding real estate exposure, reducing the overall risk of their investment strategy. - Liquidity:

Unlike physical real estate, which can take months to sell, publicly traded REITs can be bought and sold on the stock exchange within minutes. - Accessibility:

REITs enable Nigerians to invest in high-value properties, such as luxury apartments or shopping complexes, with minimal capital. - Tax Advantages:

REITs are often exempt from corporate taxes in Nigeria, meaning investors enjoy higher returns on their investments compared to traditional real estate ventures.

Are there Risks and Challenges of REITs?

While REITs are an attractive investment, they also come with risks:

- Interest Rate Sensitivity:

REITs often perform inversely to interest rates. When rates rise, borrowing costs increase, and REIT dividends may become less attractive compared to fixed-income securities. - Sector-Specific Risks:

Some REITs focus on specific sectors, such as retail or hospitality. A downturn in that sector could significantly affect performance. For example, retail REITs in Nigeria might face challenges as e-commerce grows. - Management Fees and Costs:

Some REITs charge high management fees, reducing the overall returns for investors. - Limited Growth Potential:

Since REITs are required to pay out most of their earnings as dividends, they have less capital to reinvest, which can limit growth compared to other investments.

How to Start Investing in REITs

Getting started with REITs in Nigeria is relatively straightforward. Here are some steps:

- Choose the Type of REIT:

Decide whether to invest in equity, mortgage, or hybrid REITs based on your financial goals and risk tolerance. - Evaluate REIT Performance:

Use metrics such as Funds From Operations (FFO) to assess profitability and Net Asset Value (NAV) to determine a REIT’s market valuation. - Explore Nigerian REITs:

Research options like the UPDC REIT, which focuses on commercial and residential properties, or the SFS REIT, which targets diverse real estate projects. - Buy Shares Through a Stockbroker:

Publicly traded REITs can be purchased on the Nigerian Exchange. Partner with a licensed stockbroker to facilitate your investment. - Monitor Your Investment:

Stay informed about market trends and the performance of your REIT. Consider reinvesting dividends to compound your returns over time.

Real-Life Examples of Successful REITs

Several REITs have demonstrated their potential for steady income and growth:

- UPDC REIT: This Nigerian REIT manages a portfolio of residential and commercial properties, providing investors with exposure to Lagos’s bustling real estate market.

- SFS REIT: Known for its diversified holdings, including office spaces and retail properties, this REIT caters to investors seeking stable and reliable returns.

- African REIT Initiatives: Across the continent, REITs are gaining traction as innovative solutions for real estate financing and investment.

Conclusion

Real Estate Investment Trusts (REITs) offer Nigerians an opportunity to participate in the lucrative real estate market without the burdens of direct property ownership. With benefits like passive income, diversification, and accessibility, REITs have become an essential tool for modern investors.

By understanding the basics of REITs, exploring available options, and staying informed about market trends, you can unlock the potential of real estate investing in Nigeria. Start small, research thoroughly, and take your first step toward financial growth with REITs today!